S Corp Tax-Saving Strategies 2024

S Corp Tax-Saving Strategies 2024. Everything you need to know. Buyers may acquire an s corporation in many ways.

Let’s look at some numbers to see how this works. When it comes to your.

We Share 14 Strategies To Help You Keep More Of Your Hard Earned Money.

Business owners face major decisions when first establishing a company around optimal corporate structure options balancing legal protections, operational.

Business Owners Need To Learn About These S Corp Tax Savings Opportunities, As They Can Significantly Impact Their Financial Outcomes.

If you’re looking for a business.

Here’s How Your Taxes Stack Up As A Sole.

Images References :

Source: smithpartnerswealth.com

Source: smithpartnerswealth.com

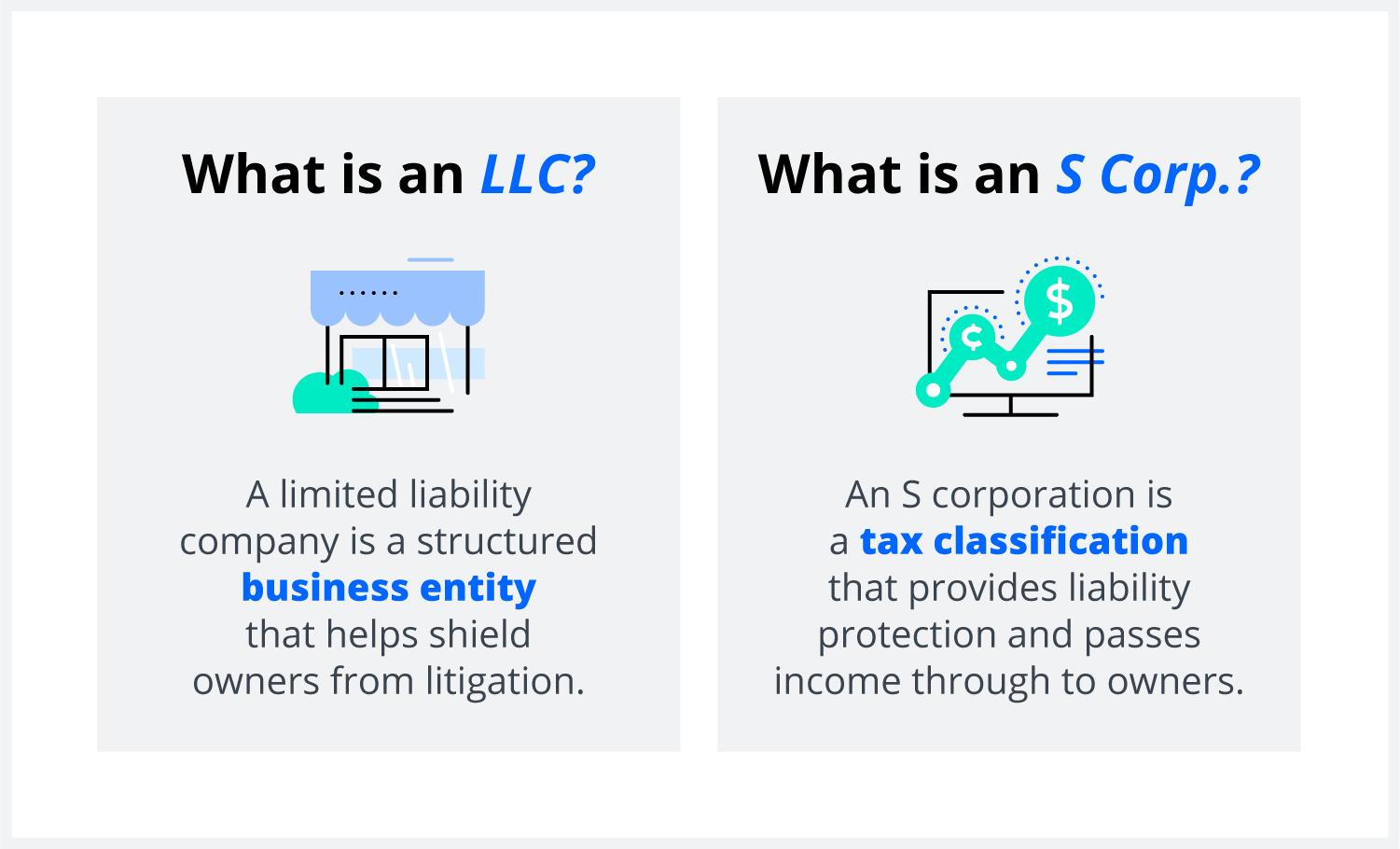

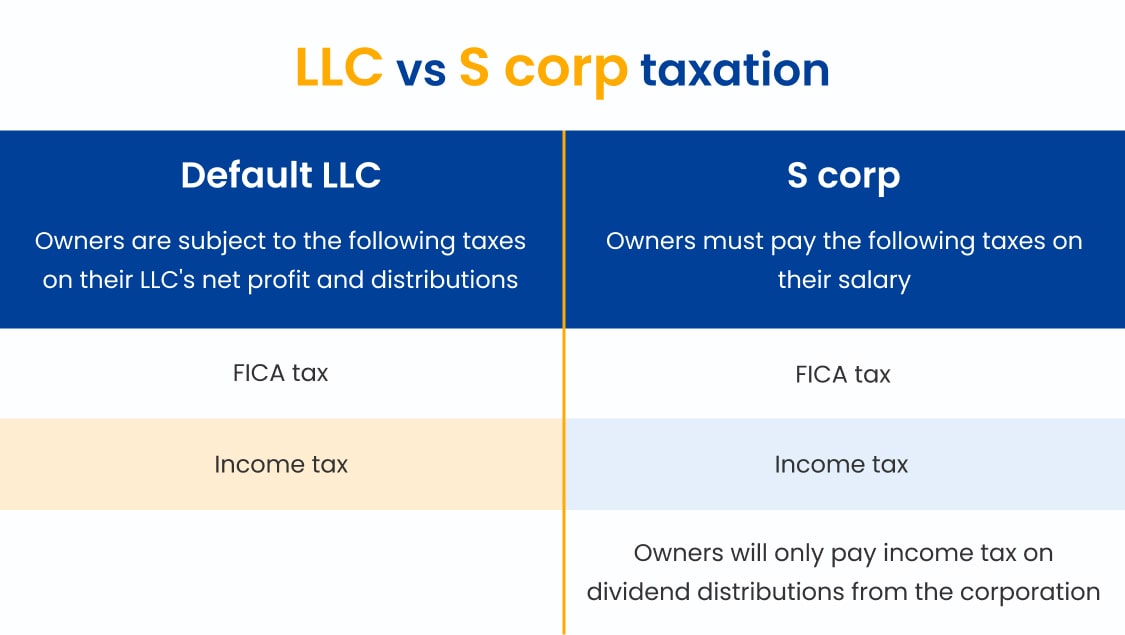

Should Your LLC Be Taxed as a Partnership or an SCorp? Smith, Below are three basic scenarios for acquiring an s corporation target. Let’s look at some numbers to see how this works.

Source: bbcincorp.com

Source: bbcincorp.com

Detailed Explanation For Difference Between LLC and S Corp, If you’re looking for a business. For 2024, s corp taxes are due on march 15,.

Source: www.pinterest.com

Source: www.pinterest.com

SCorp S corporation, Profitable business, Business, Accordingly, the paragraphs that follow describe the big benefit of an s. If you’re a business owner or entrepreneur, you want to have a good understanding of how s corporations save small business owners tax.

Source: christianfinancialadvisors.com

Source: christianfinancialadvisors.com

2022 Year End Tax Strategies Christian Financial Advisors®, A potential buyer meets the. Tax planning means acting well before your return is due.

Source: www.pinterest.com

Source: www.pinterest.com

LLC vs. SCorp Business law, Limited liability company, Business offer, / news / by jasmine dilucci. Business owners face major decisions when first establishing a company around optimal corporate structure options balancing legal protections, operational.

Source: www.youtube.com

Source: www.youtube.com

LLC vs S Corp Tax Benefits, Differences, & Strategies 2024 YouTube, Below are three basic scenarios for acquiring an s corporation target. Tax planning is part of running a successful business.

Source: brooklyntrustandwill.com

Source: brooklyntrustandwill.com

LLC vs SCorp. Comparison, A flexible operating entity that can divert most of your income to an s corporation (saving employment taxes) and take advantage of a lower tax bracket and the fringe benefits of. Tech companies in particular face a significant number of possible tax law changes and challenges in 2024,.

Source: rbataxadvisors.com

Source: rbataxadvisors.com

LLC vs SCorporation Which One Can Save You More On Your Taxes? — RBA, S corporation write offs are costs that you have incurred while operating your business that can be removed from. For 2024, s corp taxes are due on march 15,.

Source: scorptaxbook.com

Source: scorptaxbook.com

New SCorp Tax Benefits, Deductions & Strategies Book, This video explains how s corps can benef. Everyone’s situation is different and the general guidance provided.

Source: mindthetax.com

Source: mindthetax.com

21 Tax Saving Strategies for 2022 Legally Reduce Tax Liability, We share 14 strategies to help you keep more of your hard earned money. S corp tax saving strategies:

As We Look Ahead To 2024, It’s Clear That There Will Be Substantial Changes In Tax Strategies For S Corporations.

Below are three basic scenarios for acquiring an s corporation target.

Let’s Look At Some Numbers To See How This Works.

Say you earn $150,000 in revenue as the owner of a consulting firm.