What Is The Illinois Estate Tax Exemption For 2025

What Is The Illinois Estate Tax Exemption For 2025. It currently operates under a graduated tax system, with exemptions and rates that vary based. However, 2025 will be a.

On top of this tax, the estate may be subject to the federal estate tax. It currently operates under a graduated tax system, with exemptions and rates that vary based.

What Is The Illinois Estate Tax Exemption For 2025 Images References :

Source: jacobsenorr.com

Source: jacobsenorr.com

Navigating the Sunset of the Federal Estate Tax Exemption Key, In the realm of the estate and gift tax, the basic exclusion for decedents in 2025 is $13,990,000.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates, Learn how to prepare now.

Source: gustyyingaberg.pages.dev

Source: gustyyingaberg.pages.dev

Estate Tax Exemption 2024 Illinois Calculator Gerti Juliane, Current lifetime estate tax exemption of $13,610,000 per person (for 2024) with a 40% tax rate will decrease to $5,000,000 per person (plus inflation indexing) on january 1, 2026, once the tax cuts and jobs act expires.

Source: local.aarp.org

Source: local.aarp.org

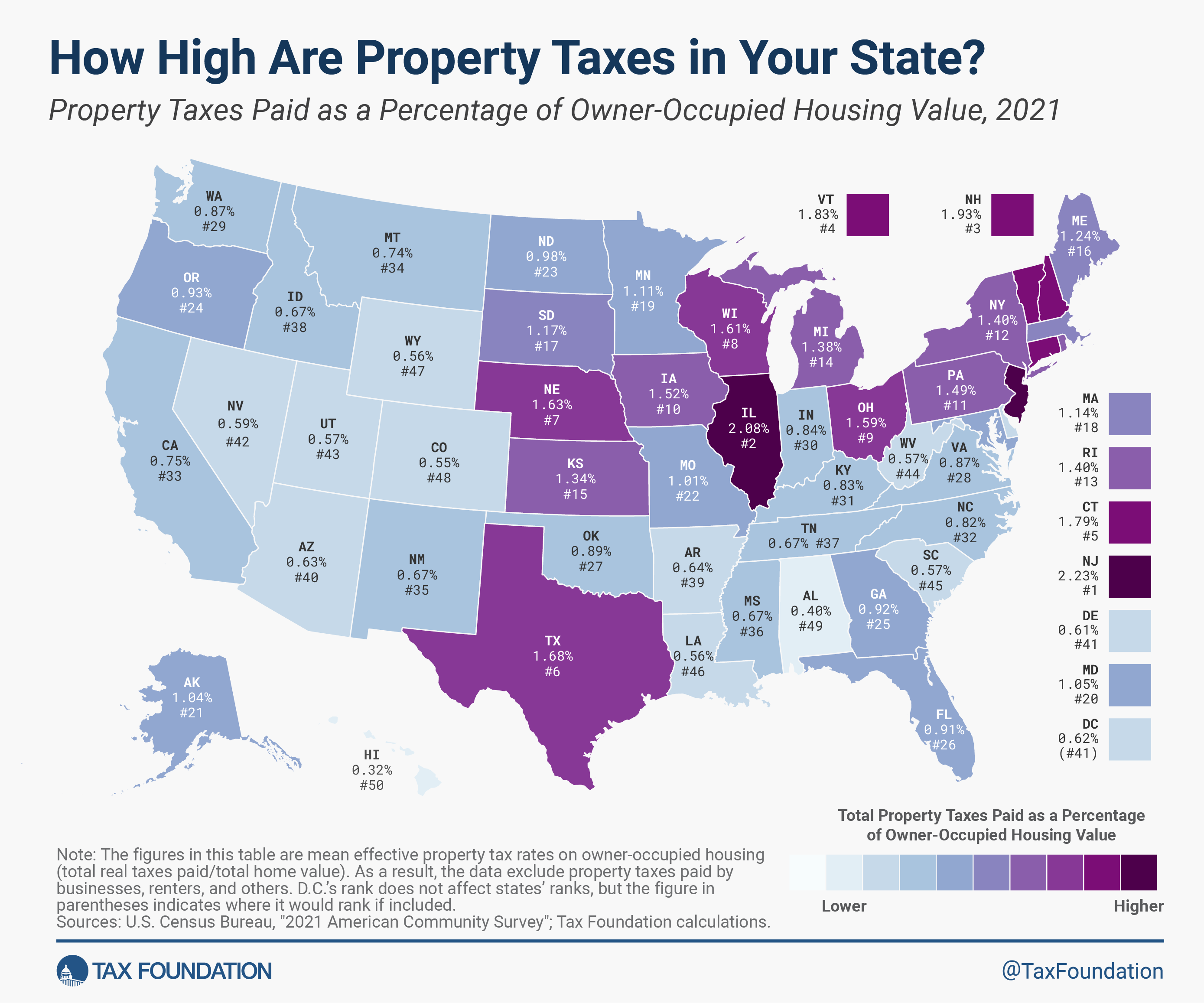

Tax Guide What You’ll Pay in 2024, The illinois estate tax rate starts at 0% on the first $40,000 of the value of estates above $4 million.

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png) Source: thedabtheodora.pages.dev

Source: thedabtheodora.pages.dev

Estate Tax Exemption 2024 Illinois State Zorah Kiersten, This means that if someone passes away and their total estate is worth less than $4.

Source: andersonadvisors.com

Source: andersonadvisors.com

Estate Tax Exemption How Much It Is and How to Calculate It, Illinois, like many states, imposes an estate tax on the transfer of a deceased person's estate.

Source: 2025and2026schoolcalendar.pages.dev

Source: 2025and2026schoolcalendar.pages.dev

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, The most recent forms are.

Source: itep.org

Source: itep.org

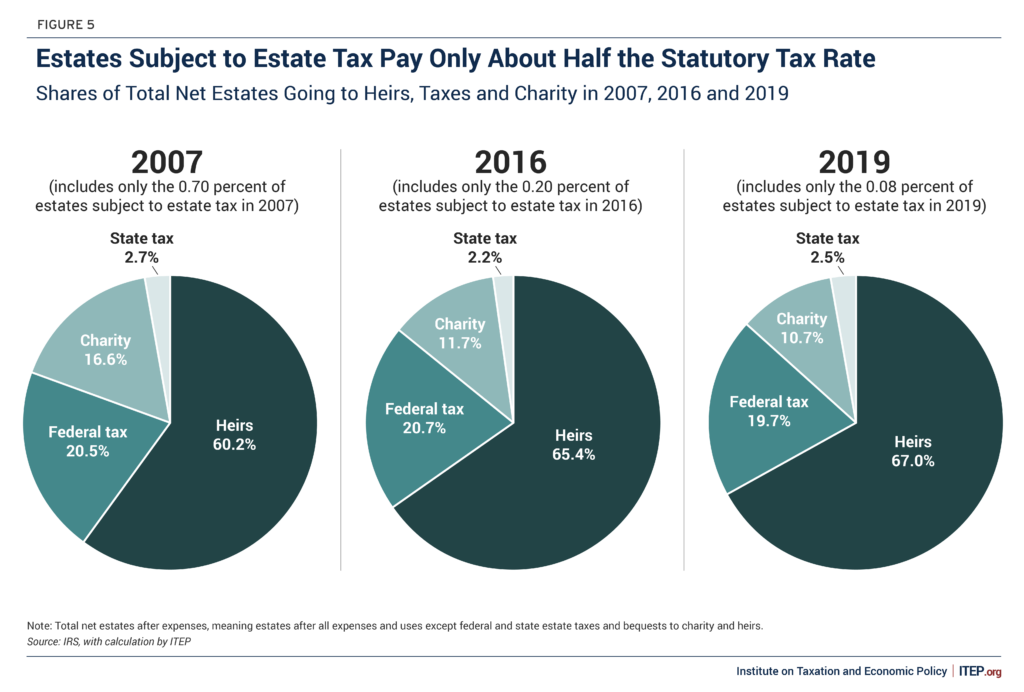

The Estate Tax is Irrelevant to More Than 99 Percent of Americans ITEP, An experienced estate planning attorney can advise you on illinois estate tax emotions based on the value of your.

Source: marijowallina.pages.dev

Source: marijowallina.pages.dev

Illinois State Estate Tax Exemption 2024 Alice Babette, As the estate tax exemption is set to decrease in 2026, learn how to plan ahead with strategies like spousal lifetime access trusts (slats) and family partnerships.

Source: www.kiplinger.com

Source: www.kiplinger.com

2023 Estate Tax Exemption Amount Increases Kiplinger, Illinois, like many states, imposes an estate tax on the transfer of a deceased person's estate.

Posted in 2025